Title: Secure Credit Card Authorization: How K-TechPay Ensures Your Financial Protection

Introduction:

In today's digital age, credit card transactions have become an integral part of our daily lives. However, with the increasing prevalence of cybercrime, ensuring the security of these transactions is of paramount importance. K-TechPay, a leading payment solution provider, has implemented robust measures to secure the credit card authorization process, safeguarding your financial information and providing peace of mind.

Understanding Credit Card Authorization:

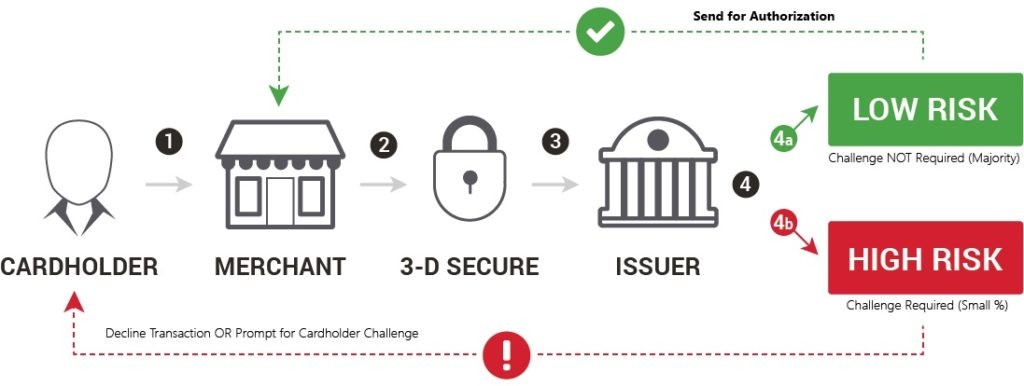

Credit card authorization is the process of verifying the validity of a credit card and confirming whether sufficient funds are available for a particular transaction. When you make a purchase using your credit card, the authorization process plays a crucial role in ensuring that your payment is legitimate and that the funds will be transferred securely.

The Importance of Security in Credit Card Authorization:

Unauthorized access, data breaches, and identity theft are constant concerns when it comes to online transactions. Cybercriminals are constantly evolving their techniques, making it essential for payment solution providers to adopt stringent security measures to protect customers' sensitive information.

K-TechPay's Commitment to Security:

K-TechPay understands the significance of maintaining the highest level of security in the credit card authorization process. Here are some ways in which K-TechPay ensures the security of your transactions:

1. Encrypted Communication:

K-TechPay employs state-of-the-art encryption protocols to protect the transmission of data during the authorization process. This ensures that your credit card information remains confidential and cannot be intercepted by unauthorized parties.

2. PCI DSS Compliance:

K-TechPay adheres to the Payment Card Industry Data Security Standard (PCI DSS), a set of security standards designed to protect cardholder data. By maintaining PCI DSS compliance, K-TechPay ensures that robust security measures are in place to safeguard your credit card information.

3. Tokenization:

K-TechPay utilizes tokenization, a process that replaces sensitive data with unique identification symbols known as tokens. These tokens are useless to cybercriminals, as they do not contain any valuable information. Tokenization adds an extra layer of security, reducing the risk of data breaches.

4. Two-Factor Authentication:

To enhance security further, K-TechPay employs two-factor authentication (2FA) for credit card authorization. This involves an additional layer of verification, typically a unique code sent to your registered mobile device, which must be entered to authorize the transaction. 2FA provides an extra level of protection against unauthorized access.

5. Fraud Detection and Prevention:

K-TechPay utilizes advanced fraud detection and prevention systems. These systems employ machine learning algorithms and artificial intelligence to analyze transaction patterns, identify potential fraudulent activities, and take proactive measures to prevent unauthorized transactions.

Conclusion:

As technology continues to advance, the security of credit card authorization becomes increasingly crucial. K-TechPay recognizes this and prioritizes the protection of your financial information. By implementing stringent security measures such as encrypted communication, PCI DSS compliance, tokenization, two-factor authentication, and advanced fraud detection, K-TechPay ensures a secure credit card authorization process.

When choosing payment solutions or conducting online transactions, it is essential to opt for trusted providers like K-TechPay, who prioritize the security and privacy of their customers. With their robust security measures in place, K-TechPay offers you peace of mind while conducting credit card transactions in the digital world.